When buying a small business, taxes can make or break your deal. Here's why they matter and how to avoid costly mistakes:

- Deal Structure Impacts Taxes: Asset purchases often offer better tax benefits (like depreciation) than stock purchases.

- Hidden Costs: Transfer taxes, like real estate excise taxes, can add tens of thousands to your acquisition costs.

- Capital Gains: Long-term gains are taxed lower than short-term gains, so timing and deal structure are key.

- Tax Planning Saves Money: Proper allocation of purchase price and leveraging strategies like QSBS exemptions can reduce your tax burden.

Quick Tip: Always involve tax advisors early to avoid errors and maximize savings.

Important Tax Factors in Small Business Acquisitions

Understanding Transfer Taxes

When you acquire a business, transfer taxes - like real estate excise and use taxes - can add unexpected costs. These taxes kick in when ownership of valuable assets changes hands, and the rates depend on the location. If overlooked, they can significantly increase the total cost of your acquisition.

For instance, if you're buying a $2 million manufacturing business that includes an $800,000 warehouse, you might face a 5% real estate excise tax and a 0.5% use tax. That adds up to $50,000 in transfer taxes [2]. These expenses directly impact your overall investment and potential returns, so it's essential to plan for them from the start.

In addition to transfer taxes, how you structure the purchase - whether as an asset or stock deal - also has major tax consequences.

Tax Differences: Asset vs. Stock Purchases

The way you structure the purchase affects your tax liabilities and overall financial outcomes. Here's a breakdown of key differences between asset and stock purchases:

| Aspect | Asset Purchase | Stock Purchase |

|---|---|---|

| Tax Basis and Depreciation | Adjusts to fair market value with a new depreciation schedule | Retains historical tax basis and schedule |

| Tax Treatment | Taxed at the asset level | Taxed at the corporate level (C-corps) |

| Pass-through | Gains/losses flow to personal returns for partnerships/S-corps | No pass-through benefits |

Asset purchases often provide better tax advantages because you can adjust the tax basis of the acquired assets to their current market value [1][4].

Capital Gains Taxes: Short-term and Long-term

Capital gains taxes play a big role in how acquisition deals are structured. Short-term capital gains are taxed at higher ordinary income rates, while long-term gains enjoy lower tax rates [1].

For example, if you're buying a business where the seller has held assets for less than a year, they might push for a higher price to offset their short-term capital gains tax liability [3]. Timing can make a big difference here. Structuring deals to qualify for long-term capital gains rates, or using strategies like QSBS (Qualified Small Business Stock) treatment, can lead to major tax savings over time [3].

To navigate these complexities, it's smart to work with tax advisors. They can help you structure deals that reduce tax burdens for both you and the seller, ensuring a smoother and more cost-effective acquisition process.

Ways to Reduce Tax Liabilities

Tax Savings Through Asset Purchases

Allocating purchase prices strategically when buying business assets can lower your tax bill. By assigning values to assets with shorter depreciation periods, you can claim deductions faster, all while staying within IRS guidelines [1]. This approach not only helps you save on taxes but also improves cash flow.

For example, assigning a portion of the purchase price to goodwill allows you to amortize it over 15 years, which reduces your taxable income annually [1]. Additionally, long-term strategies like utilizing QSBS exemptions can lead to even more savings down the road.

How QSBS Exemptions Help Buyers

Qualified Small Business Stock (QSBS) exemptions can be a game-changer for buyers focusing on long-term gains. If you acquire QSBS after September 27, 2010, you may exclude up to $10 million - or 10 times your adjusted basis - from federal capital gains taxes. To qualify, the stock must be held for at least five years, and the business must operate as a C-corporation [3].

This is especially beneficial for high-growth companies where substantial value increases are expected. However, leveraging QSBS exemptions effectively requires a clear understanding of the rules and proper planning.

Why Tax Advisors Are Essential in Deal Structuring

Experienced tax advisors play a key role in helping you identify and take full advantage of tax-saving opportunities. They can guide you in structuring deals to reduce transfer taxes and maximize deductions [2]. Their expertise ensures that your approach aligns with tax laws while optimizing your financial outcomes.

Tax advisors can assist with tasks like:

- Identifying QSBS-eligible opportunities

- Drafting and reviewing asset purchase agreements

- Navigating intricate local tax regulations

- Ensuring accurate purchase price allocations [2][4]

While tax planning is important, it should always complement your overall business goals. Consulting with qualified tax professionals ensures your strategies are effective, compliant, and aligned with both short- and long-term objectives.

Buying an Existing Business: Ways to do it and its tax consequences

sbb-itb-cce425d

Examples of Tax Effects in Small Business Acquisitions

Real-world examples show how smart tax strategies can lower acquisition costs and boost long-term savings.

Case Study: Asset vs. Stock Purchase Tax Impact

In a $1 million business acquisition, allocating the purchase as an asset deal allowed the buyer to claim around $85,000 annually in tax deductions through depreciation and amortization [1]. On the other hand, a stock purchase would have resulted in much smaller annual deductions, reducing potential savings.

Example: Reducing Transfer Taxes

In Washington state, a $2 million business acquisition included $800,000 in commercial real estate. By assigning more value to personal property, which had lower tax rates, the buyer cut their transfer tax bill from $50,000 to about $42,000 [2]. This example highlights how strategic planning can trim acquisition costs.

Scenario: Benefits of QSBS

A buyer who held Qualified Small Business Stock (QSBS) for five years avoided $2 million in federal taxes when selling shares purchased for $500,000 that grew to $2.5 million. This showcases the powerful tax advantages available to long-term QSBS investors [3].

These cases highlight how careful tax planning can make a big difference in the overall financial outcome of a business acquisition.

Conclusion: Tax Planning in Small Business Acquisitions

Key Points for Buyers

Tax planning plays a crucial role in small business acquisitions. Knowing how transfer taxes differ by location and understanding the choice between asset and stock purchases can help buyers avoid expensive errors and save money. For instance, asset purchases often allow buyers to benefit from an adjusted tax basis and depreciation deductions, which can reduce tax liability over time [1]. Additionally, the timing and structure of a deal can make a big difference in cutting acquisition costs.

For qualifying buyers, QSBS (Qualified Small Business Stock) exemptions can provide a major reduction in long-term capital gains taxes [3]. That said, successful acquisitions require a thorough tax strategy that addresses both upfront costs and future tax considerations.

Final Advice on Tax Strategies

Handling tax complexities requires careful planning. Getting tax advisors involved early allows buyers to uncover ways to save on taxes through well-thought-out deal structuring and accurate documentation. This is especially helpful when dealing with local tax laws and determining the best purchase price allocations [2].

"Proper tax planning, including understanding transfer taxes and structuring the deal to minimize these costs, can help buyers avoid costly mistakes during the acquisition process." [2]

The best acquisitions make tax planning a priority from the start. By collaborating with experienced advisors and taking advantage of available tax benefits, buyers can structure deals that improve their tax outcomes and boost overall returns. With these strategies in place, buyers can approach acquisitions more effectively and with greater confidence.

FAQs

What is tax deductible when buying a business?

When you buy a business, the IRS allows certain deductions to help offset acquisition costs. For purchases under $50,000, you can deduct up to $5,000 in startup and organizational costs, with reduced deductions for higher-priced purchases [1].

Here are some common deductible expenses:

| Deductible Items | Details |

|---|---|

| Asset Purchase Depreciation | Adjusting assets to fair market value allows for larger depreciation deductions [1] |

| Professional Fees | Costs for legal, accounting, and advisory services directly related to the purchase |

| Transaction-related Costs | Includes transfer taxes and due diligence expenses, depending on state laws [2] |

For example, if you adjust the purchase price of a $1 million business to reflect fair market value, you can claim depreciation deductions over time, reducing your taxable income [1].

The exact deductions depend on factors like the transaction structure, local tax rules, the type of business entity, and how the purchase price is allocated. To make the most of these opportunities, it's critical to work with tax advisors. They can help you identify all eligible deductions and structure the deal to minimize your tax liability [4].

Squash CPA

Squash CPA

National Franchise Sales

National Franchise Sales

Arena Commercial Capital

Arena Commercial Capital

Virtual Services Company

Virtual Services Company

Southstar Capital

Southstar Capital

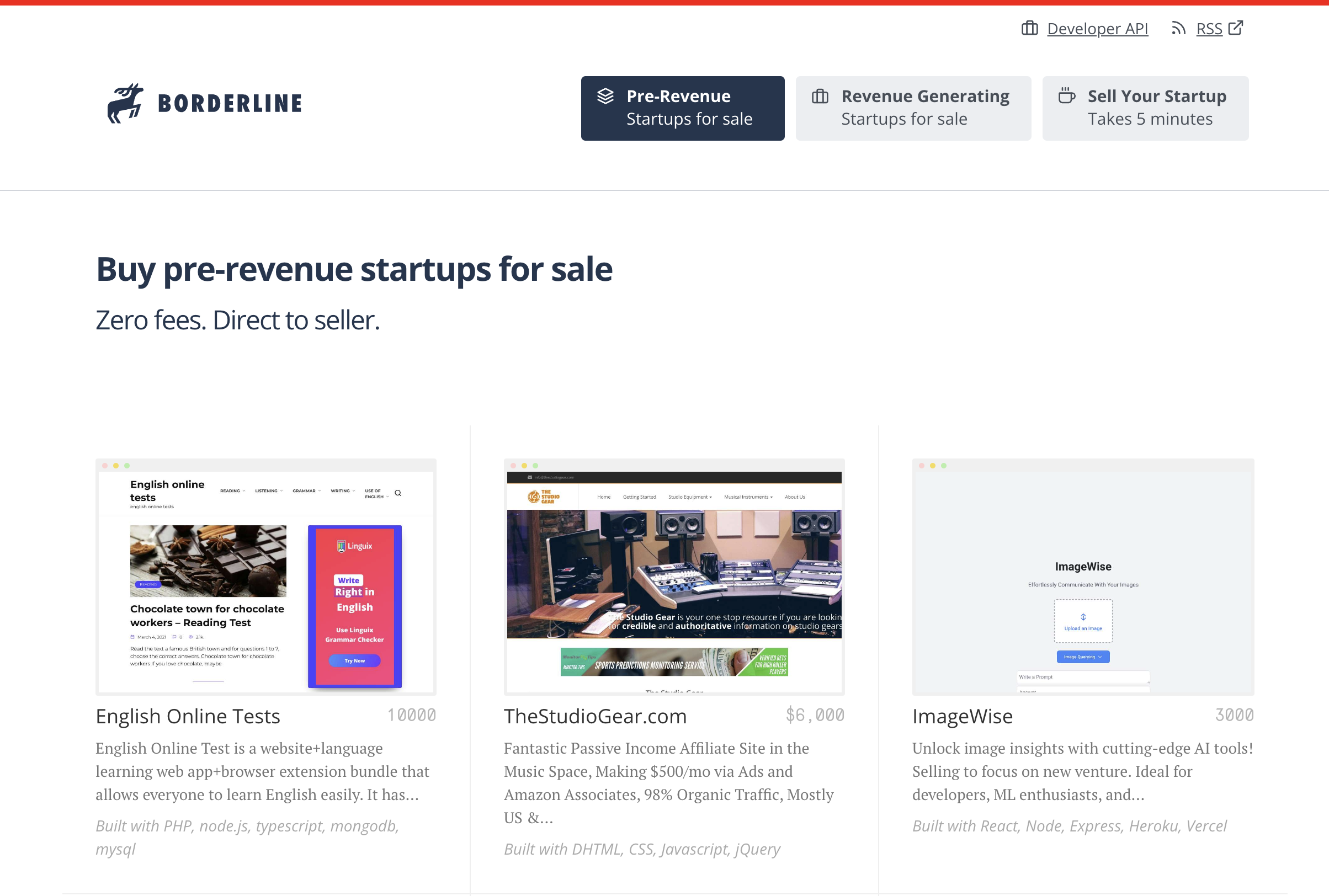

Borderline

Borderline

Soundfront - HubSpot for Investment Banking and Private Equity

Soundfront - HubSpot for Investment Banking and Private Equity

Balance Point Capital

Balance Point Capital

Welcome to Clearly Acquired | Fund Growth. Acquire Quality. Close with Confidence.

Welcome to Clearly Acquired | Fund Growth. Acquire Quality. Close with Confidence.

Prouw Consulting

Prouw Consulting

BizBen.com

BizBen.com

Allegiance Capital Corporation

Allegiance Capital Corporation

Crescent Capital

Crescent Capital

SBA University

SBA University

Futurise Growth Partners | Exit Planning | Business Value Growth

Futurise Growth Partners | Exit Planning | Business Value Growth

Synovus

Synovus