Closing a business negotiation successfully can make or break your deal. Here's how to ensure smooth closures that benefit all parties:

- Preparation is key: Know your business value, set clear goals, and organize essential documents.

- Build trust: Establish ground rules, maintain transparency, and communicate effectively.

- Handle objections calmly: Acknowledge concerns and offer data-backed solutions.

- Set deadlines and contingencies: Use timelines to create urgency and keep negotiations on track.

- Finalize the deal thoroughly: Review purchase agreements, transfer ownership, and inform stakeholders.

This guide walks you through every step to close negotiations confidently, ensuring better terms, stronger relationships, and a seamless transition.

How to Win a Negotiation

Preparation: Steps for Successful Negotiations

Thorough preparation is the backbone of any successful business negotiation. Here's how to get ready and put yourself in the best position.

Assessing Your Position

Start by evaluating three critical areas to understand where you stand:

| Area to Evaluate | What to Consider | Why It Matters |

|---|---|---|

| Business Value | Financial metrics like revenue and profit margins | Helps set a fair asking price |

| Market Position | Competitor trends and market insights | Highlights areas of leverage |

| Strategic Assets | Key assets like intellectual property or partnerships | Strengthens your bargaining power |

Knowing these details will help you negotiate with confidence and avoid undervaluing your business.

Defining Goals and Limits

Set clear goals and boundaries to stay focused and avoid mistakes. Your framework should include:

- Non-negotiable terms and ideal outcomes: What must be included in the deal and what you're aiming for.

- Areas for compromise: Where you're willing to be flexible.

Defined objectives and deadlines make a big difference. Deadlines, in particular, can push both sides to find solutions and finalize agreements [1].

Collecting Key Documents

Having all necessary documents ready shows professionalism and speeds up the process. Make sure to include:

- Financial records: Statements, projections, and other key data.

- Legal agreements: Contracts, leases, or other binding documents.

- Operational resources: Standard operating procedures, customer lists, etc.

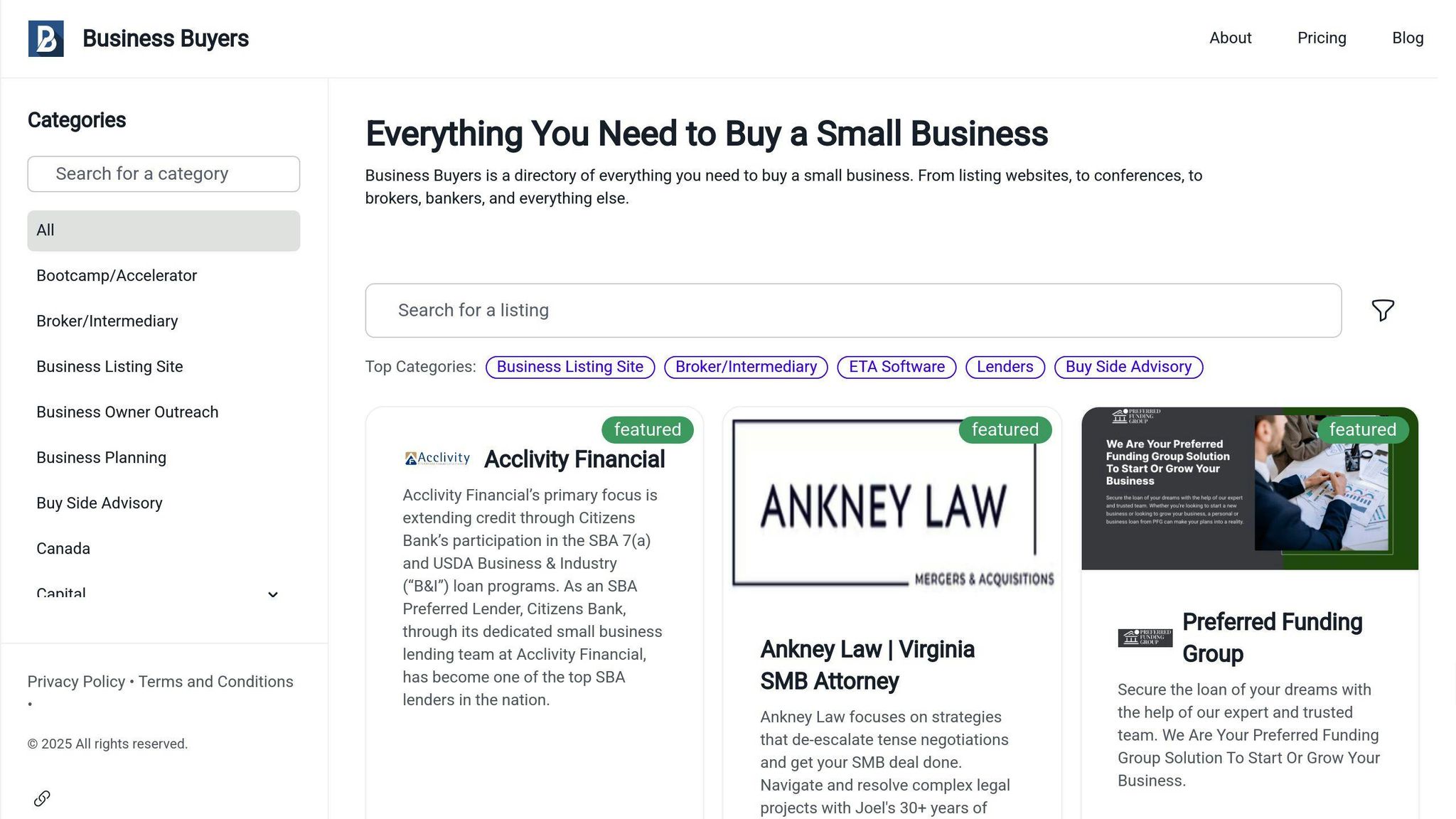

Platforms like businessbuyers.co provide tools to help with organizing documents and preparing for due diligence [2].

Once these steps are complete, you’ll be ready to focus on strategies to close the deal effectively.

Strategies for Closing Negotiations

With your preparation complete, these tips can help you wrap up negotiations effectively.

Building Trust and Setting the Stage

Trust is the backbone of any successful negotiation. Before diving into specifics, agree on the process. This helps establish a positive tone and ensures both sides are on the same page. Here are some key areas to focus on:

| Key Aspect | How to Implement | Why It Matters |

|---|---|---|

| Transparency and Ground Rules | Outline steps, timelines, and acceptable behaviors upfront | Encourages trust and keeps things professional |

| Communication Protocol | Decide on methods (e.g., email, calls) and response times | Prevents miscommunication and keeps things moving smoothly |

Handling Objections Professionally

Objections are inevitable during negotiations, especially in the final stages. The goal is to address them calmly and constructively. Here's how to approach them:

- Acknowledge concerns: Show you understand the other party's perspective.

- Provide solutions: Use data or evidence to support your responses and offer workable alternatives.

Staying composed and solution-oriented can turn objections into opportunities to strengthen the agreement.

Creating Momentum with Deadlines and Contingencies

Once objections are resolved, deadlines and contingencies can help move things forward and close the deal. Here are some effective methods:

- Exclusive Timeframes: Set specific periods for negotiations to create urgency and focus.

- Performance-Based Terms: Add conditions like penalties, bonuses, or pricing adjustments tied to performance.

When setting deadlines, ensure they're practical and considerate of both parties' needs. This approach not only keeps things professional but also strengthens the relationship as you finalize the agreement.

sbb-itb-cce425d

Finalizing the Deal

Once negotiations are complete, the focus shifts to managing legal and logistical steps to close the transaction.

Creating and Reviewing the Purchase Agreement

The purchase agreement is the backbone of your deal. Here’s what it typically includes:

| Agreement Component | Purpose | Key Points to Address |

|---|---|---|

| Purchase Terms | Lays out price, payment structure, and timeline | Include contingencies and performance benchmarks |

| Asset List | Specifies included and excluded items | Clearly outline intellectual property rights |

| Warranties | Details guarantees and representations | Mitigate risks of future claims |

| Non-compete Clauses | Safeguards the buyer’s interests | Define scope, duration, and geographic limits |

It’s essential to have a business attorney review this document to ensure everything is airtight. Platforms like Business Buyers (businessbuyers.co) can connect you with experienced legal professionals who specialize in business transactions. After finalizing the agreement, you’ll move on to transferring ownership to make the deal official.

Transferring Ownership

Ownership transfer involves coordinating several critical areas:

- Legal Documents: Update business registrations, licenses, and permits with state and local authorities.

- Financial Transfers: Handle transitions for bank accounts, credit lines, and merchant services.

- Operational Elements: Transfer vendor contracts, insurance policies, and employee benefits.

Once ownership is officially transferred, it’s important to notify everyone involved to ensure a smooth handover.

Informing Stakeholders

Clear communication with stakeholders is key to wrapping up the deal effectively. Tailor your messaging for each group:

| Stakeholder Group | Key Message Points |

|---|---|

| Key Employees | Reassure them about job security and business stability. |

| Customers | Highlight service continuity and provide updated contact details. |

| Suppliers | Clarify payment terms and any new procedures. |

| Industry Partners | Discuss plans for future collaboration. |

These steps help ensure a smooth transition for everyone involved.

Additional Resources and Tools

Closing business negotiations can be complex, but the right tools and expert advice can make the process much smoother. Below are some key resources that can help you navigate this critical stage.

Businessbuyers.co

Businessbuyers.co offers a range of tools and services designed to support buyers during negotiations. Here's what they provide:

| Resource Type | Key Features | How It Helps |

|---|---|---|

| Due Diligence Tools | Financial analysis templates, research guides | Helps validate business value and spot risks |

| Professional Directory | Listings of brokers, bankers, and advisors | Connects you with the right experts |

| Financial Modeling | Ready-made templates for projections | Aids in creating accurate valuations |

Working with Professional Advisors

Expert advisors play a critical role in managing the complexities of business deals. Here's what different types of advisors bring to the table:

| Advisor Type | Role in the Process | Best Time to Involve Them |

|---|---|---|

| Business Brokers | Match buyers and sellers, provide market insights | Early in your search for a business |

| Legal Counsel | Handle contract drafting and document review | Before making or accepting any offers |

| Financial Advisors | Conduct valuations and assess financial risks | During the due diligence phase |

When choosing advisors, prioritize those with a solid track record in your industry and experience handling deals of similar size. A well-rounded team ensures every detail is covered while keeping the process on track.

Conclusion: Key Points for Closing Business Negotiations

Recap of Key Steps

Preparation, strategy, and execution are the backbone of successful negotiations. These three elements work together to help you approach discussions confidently, close deals smoothly, and achieve favorable results.

Negotiators often worry that they will concede too much as the clock runs. But remember that the other side is equally affected by the deadline [1]

This quote from Professor Don A. Moore reminds us that deadlines impact both sides, pushing everyone toward an agreement.

Putting It Into Practice

This guide has covered how to prepare, plan, and close negotiations effectively. Now, it's time to turn these ideas into action:

- Stay organized and adapt to uncover creative solutions.

- Build and maintain strong relationships by being clear and consistent in your communication.

- Consult experts or advisors when you need extra guidance at critical points.

- Be ready to walk away if the deal doesn’t meet your standards.

Balancing firmness with adaptability will help you navigate negotiations and achieve the outcomes you’re aiming for.

FAQs

How do you close a negotiation deal?

Closing a deal requires careful planning, attention to detail, and clear communication. Building on earlier strategies, these final steps help ensure everything wraps up smoothly.

Start with Smaller Details: Begin by addressing minor points like delivery schedules or transition timelines. This shows that the major issues have been resolved and the deal is nearing completion.

Key Components for Closing a Deal:

| Component | Purpose | How to Implement |

|---|---|---|

| Clear Process | Creates a structured framework | Set ground rules and key discussion points early |

| Defined Timeline | Keeps everything on track | Include specific milestones and deadlines |

| Objection Handling | Resolves remaining concerns | Address objections directly with facts and data |

| Final Review | Confirms all terms | Document every agreed-upon detail in writing |

Get Expert Advice: Involve legal and financial professionals to handle critical aspects of the closing. Platforms like Business Buyers (businessbuyers.co) can also provide tools for thorough due diligence during this stage [2].