Buying a small business? Protect your investment with indemnification clauses and insurance. Here's what you need to know:

- Indemnification Clauses: Hold sellers accountable for breaches (e.g., false claims about finances or legal issues). Key terms include:

- Caps: Seller's maximum liability (e.g., 10% of purchase price).

- Baskets: Minimum claim threshold (e.g., $50,000 deductible).

- Escrow: Funds reserved for claims (e.g., 10-20% of purchase price).

- Representation and Warranty Insurance (RWI): Covers gaps beyond indemnification, such as hidden liabilities, tax issues, or IP disputes. Benefits include:

- Extending protection periods.

- Reducing reliance on escrow accounts.

- Offering direct payouts for claims.

Quick Tip: Combine clear indemnification terms, RWI, and thorough due diligence to limit risks and secure your purchase. Read on for negotiation tips, insurance options, and expert advice.

M&A Warranties, Representations & Indemnities

What are Indemnification Clauses?

Indemnification clauses are critical in business purchase agreements. They protect buyers from financial losses and ensure sellers are held accountable for any breaches of promises or agreements made during the transaction.

What Do Indemnification Clauses Do?

At their core, indemnification clauses are designed to shield buyers from unexpected costs. Amundsen Davis Law explains it well in their Corporate Legal Update:

"Indemnification obligations require one party to compensate the other for costs that arise relating to the performance (or lack thereof) of the terms the parties agreed to in the transaction documents" [2].

For example, if a seller claims there are no pending lawsuits but one surfaces after the deal closes, the seller is responsible for covering the buyer's financial losses.

Breaking Down Caps, Baskets, and Escrow

These three elements set clear boundaries for a seller's liability:

| Component | Description | Example |

|---|---|---|

| Caps | Limits the maximum liability of the seller | 10% of the purchase price |

| Baskets | Sets a minimum claim amount | $50,000 deductible |

| Escrow | Reserves funds for claims | 10-20% of the purchase price |

- Caps: Define the upper limit of what the seller might owe, often tied to a percentage of the purchase price.

- Baskets: Act as a deductible, meaning the buyer can only make claims exceeding a set amount (e.g., $50,000).

- Escrow: An account holding a portion of the purchase price (usually 10-20%) to ensure funds are available for any claims.

Types of Indemnification Clauses

Indemnification clauses come in various forms:

- General indemnification: Covers broad breaches of the agreement.

- Specific indemnification: Targets particular risks, like taxes or legal issues.

- Fraud-related claims: Addresses intentional misrepresentations.

Escrow accounts are often used alongside these clauses to secure funds for potential claims, giving buyers added peace of mind.

While these clauses are a strong layer of protection, buyers may also turn to insurance to cover liabilities beyond what the seller is responsible for. This combination helps reduce risk and ensure smoother transactions.

sbb-itb-cce425d

Insurance in M&A Transactions

Insurance plays a crucial role in managing risks during M&A transactions. For buyers acquiring small businesses, understanding the right insurance options can help reduce risks and make the acquisition process smoother.

How Insurance Helps Buyers

Representation and warranty insurance is a valuable tool for reducing risks in M&A deals. Here’s how it benefits buyers:

- Extends the time to identify potential issues

- Reduces the need for seller escrow accounts, freeing up funds

- Makes offers more attractive to sellers

- Maintains good relationships with sellers after closing

The biggest advantage? It removes concerns about whether the seller can pay claims, giving buyers direct access to insurance coverage when needed.

| Insurance Benefit | Impact |

|---|---|

| Extended Protection | More time to discover claims |

| Capital Efficiency | Less reliance on escrow accounts |

| Claim Resolution | Direct access to insurance payouts |

| Relationship Management | Reduces tension with sellers |

With these advantages, it’s worth diving into the specific types of insurance that can safeguard buyers in M&A transactions.

Available Insurance Types

Representation and warranty insurance is one of the most effective ways to address risks. It complements indemnification clauses by covering issues that go beyond caps and baskets, such as:

- Financial and operational risks

- Tax and compliance concerns

- Intellectual property disputes

However, buyers need to carefully review change-of-control clauses in existing insurance policies. Ownership transfers can sometimes cancel coverage automatically.

"Representation and warranty insurance can speed up a business sale by covering the liabilities of future representations and warranties claims, allow buyers to place lower bids, and enable sellers to fully leave a business and its responsibilities" [3].

Buyers should customize their insurance coverage based on risks identified during due diligence. Setting the right policy limits with the help of experienced insurance advisors ensures that coverage aligns with the transaction size and industry-specific challenges.

Tips for Buyers

Negotiating Indemnification Clauses

When working through indemnification terms, buyers should aim to safeguard their position effectively. Focus on securing higher caps and lower baskets to reduce exposure to potential risks.

| Negotiation Priority | Key Consideration | Action |

|---|---|---|

| Liability Coverage | Financial exposure | Set caps at 30-50% of purchase price |

| Basket Structure | Claim threshold | Opt for tipping baskets |

| Time Limits | Claim period | Extend periods for taxes and key reps |

| Escrow Amount | Security for claims | Aim for 10-15% of purchase price |

While good negotiation tactics are critical, having legal expertise ensures that your agreements are both enforceable and thorough.

When to Consult Legal Experts

It's wise to bring in legal counsel early in the process for tasks like:

- Reviewing indemnification clauses

- Structuring appropriate insurance coverage

- Assessing complex liability situations

- Negotiating escrow terms

"Experts recommend that buyers conduct thorough due diligence, negotiate favorable indemnification terms, and consider purchasing additional insurance coverage to mitigate potential liabilities. They also emphasize the importance of consulting legal experts early in the negotiation process to ensure that buyers' interests are protected" [2][4].

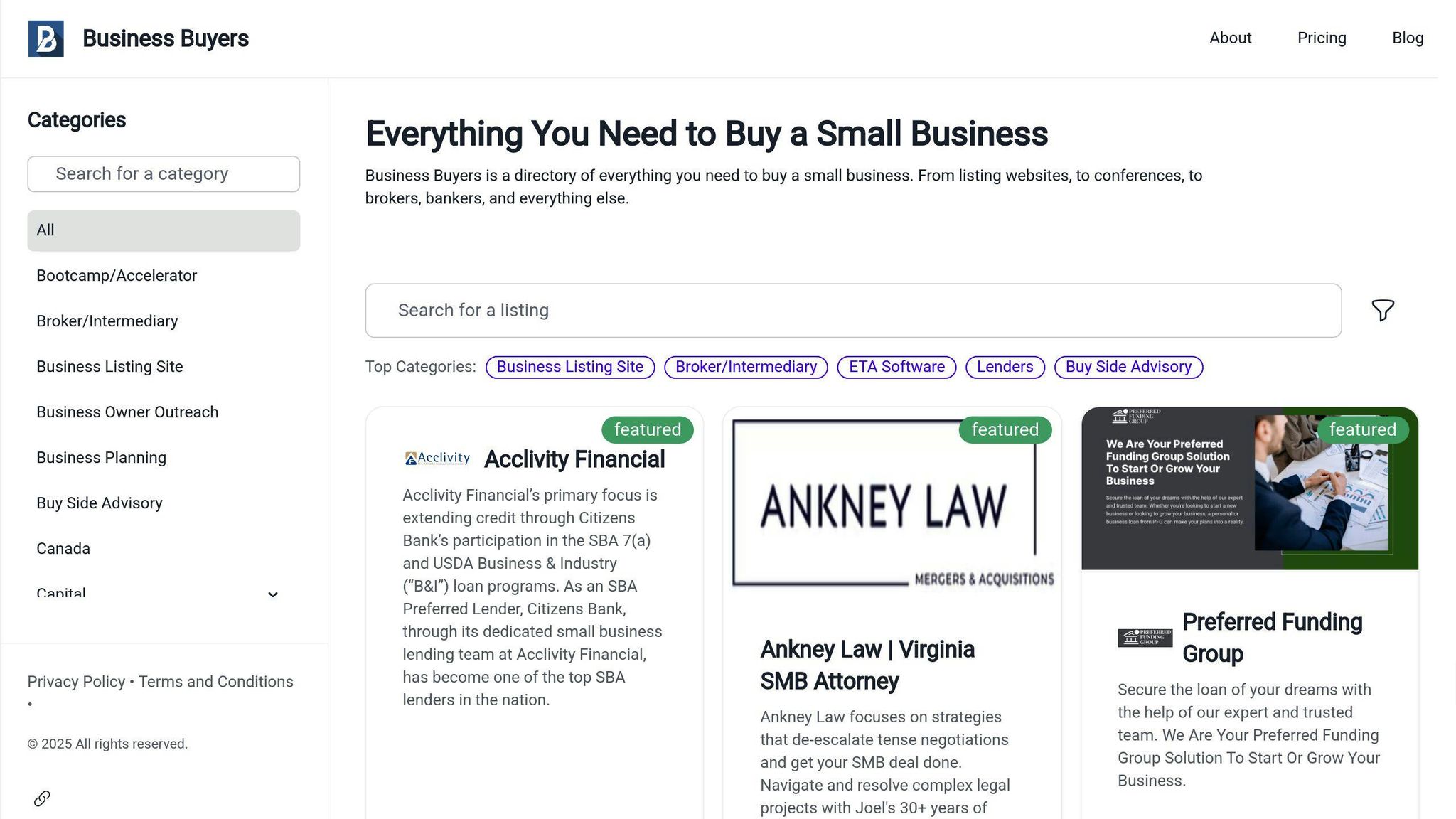

Using Business Buyers as a Resource

Business Buyers (businessbuyers.co) offers tools for due diligence, financial modeling, and connects buyers with M&A insurance specialists. Pairing these resources with professional advice is a smart way to ensure you’re fully protected during acquisitions.

Conclusion

Indemnification clauses and insurance play a crucial role in managing risks during small business acquisitions. With M&A transactions becoming more intricate, tools like Representation and Warranty Insurance (RWI) have emerged as key components for managing potential liabilities [1].

To increase the chances of a successful acquisition, buyers should focus on a few critical steps:

- Negotiate clear indemnification terms: Ensure caps, baskets, and escrow provisions are well-defined.

- Secure appropriate insurance: RWI can help cover potential gaps in representations and warranties.

- Perform detailed due diligence: Early identification of risks can prevent costly surprises later.

By combining these efforts, buyers can approach acquisitions with greater confidence and limit their financial exposure.

Expert guidance and the right resources are essential for navigating M&A transactions. Platforms like Business Buyers (businessbuyers.co) offer tools for due diligence, financial modeling, and connecting with experienced M&A professionals.

Careful planning around indemnification and insurance ensures buyers are ready to handle the uncertainties that come with small business acquisitions. Leveraging expert resources like Business Buyers can provide the support needed to safeguard investments and approach acquisitions with confidence.