When buying a business, working with a broker can simplify the process and help you avoid costly mistakes. Brokers assist with tasks like business valuation, negotiations, due diligence, and ensuring confidentiality. They also connect you with opportunities you might not find on your own. Here's what you need to know:

- Define Your Goals: Be clear about your industry, budget, location, and long-term vision.

- Choose the Right Broker: Look for experience, credentials, and client references. Decide between passive (low involvement) or active (personalized) services.

- Navigate the Process: Brokers guide you through NDAs, valuations, negotiations, and closing the deal.

- Maintain a Good Relationship: Communicate clearly, respect their expertise, and use their market insights.

Brokers charge fees (up to 12% of the purchase price), but their expertise can make the investment worthwhile. By collaborating effectively, you can find the right business and close the deal smoothly.

What Is A Business Broker

1. Define Your Acquisition Goals

Having clear goals makes it easier for brokers to find businesses that align with what you're looking for. Before reaching out to business brokers, take time to map out your acquisition criteria to streamline your search.

Choose Your Industry and Business Type

Pick industries where you already have experience or a strong interest. Evaluate the market's potential and whether you can manage operations effectively in that space. Look at both the market's future prospects and your ability to thrive within it.

Set Your Budget and Location

Knowing your financial limits is key to narrowing down your options. Here are some important financial factors to consider:

| Financial Consideration | What to Evaluate |

|---|---|

| Funding Sources | Personal savings, SBA loans, seller financing, or traditional bank loans |

| Working Capital | Extra funds required to keep the business running smoothly |

For location, think about factors like market demand, access to a skilled workforce, and the area's economic climate.

Clarify Your Long-Term Goals

Your vision for the business will influence the options brokers suggest. Define what you want in terms of revenue growth, profit margins, how involved you want to be, and your eventual exit strategy. This helps brokers recommend businesses that match your ambitions while also pointing out any hurdles you might face.

Once your acquisition goals are set, the next step is finding a broker who can turn those goals into reality.

2. Find and Select a Broker

Once you’ve set your goals, the next step is choosing a broker who can help make them happen.

Evaluate Broker Expertise and Track Record

When comparing brokers, focus on their industry experience, credentials like the Certified Business Intermediary (CBI) designation, membership in organizations like the IBBA, and their transaction history. Ask for client references to get a sense of their reliability. Look for brokers who have a solid history in your specific sector and recent feedback from both buyers and sellers [1] [2].

Decide on Passive vs. Active Broker Services

Brokers generally offer two types of services. Passive services give you access to listed businesses without upfront fees. Active services, on the other hand, involve a more tailored approach, including personalized searches and ongoing support, typically requiring a retainer and monthly fees. Decide which approach aligns better with your needs.

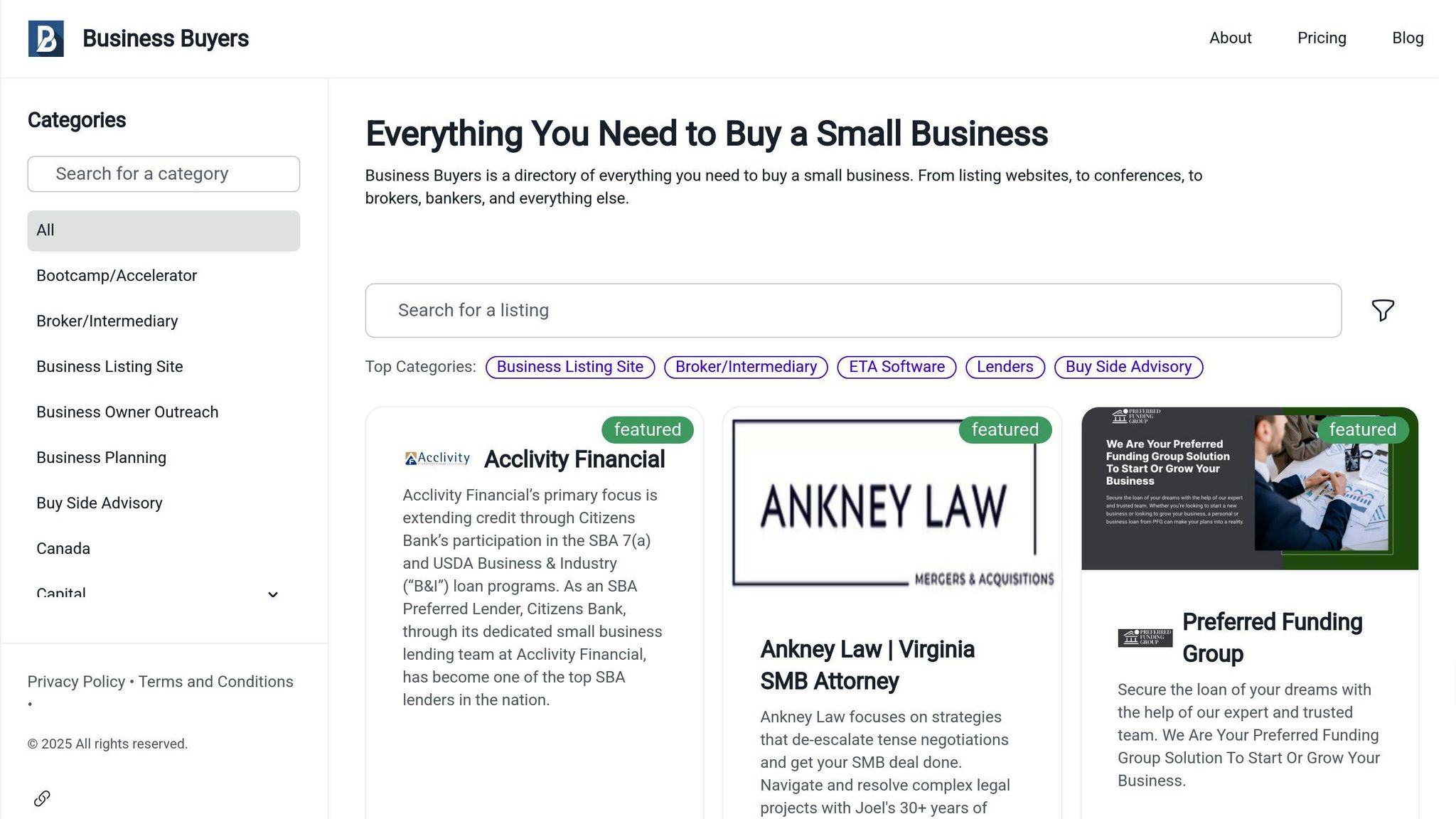

Leverage Platforms Like BusinessBuyers.co

Online tools can make finding the right broker easier. For example, BusinessBuyers.co connects you with brokers based on your industry and provides resources for due diligence and acquisition planning. These tools can save time and help you focus on finding the best opportunities.

After choosing a broker, they’ll assist you throughout the acquisition process, from the first interaction to finalizing the deal.

sbb-itb-cce425d

3. Work Through the Acquisition Process with a Broker

Once you've chosen the right broker, they will guide you through each step of the acquisition process.

Start with Contact and Due Diligence

The process begins with signing an NDA, allowing you access to confidential business information and demonstrating your seriousness as a buyer.

Your broker will set up a data room containing key documents, such as:

- Financial statements

- Contracts

- Operational metrics

- Details about key relationships

After reviewing these materials, you'll evaluate the business's worth and start negotiating the terms.

Handle Valuation and Negotiation

The valuation stage involves your broker using various methods to determine the business's market value:

| Valuation Method | Focus Area |

|---|---|

| Income Approach | Earnings and cash flow |

| Market Approach | Comparable sales in the market |

| Asset-Based Approach | Value of tangible and intangible assets |

Your broker will also help negotiate critical aspects of the deal, such as:

- Purchase price and payment terms

- Asset allocation

- Non-compete agreements

- Transition period arrangements

- Employee retention plans

Once the terms are set, the next step is ensuring everything is ready for closing.

Finalize the Deal

In the final phase, your broker will work with other professionals to ensure everything goes smoothly. Their responsibilities include:

- Overseeing the preparation and review of the purchase agreement

- Coordinating with attorneys and accountants

- Managing the final due diligence process

- Addressing any last-minute negotiations

- Facilitating the closing process

For more complex deals, brokers may use solutions like escrow to address potential risks or concerns [3]. Their job is to manage communications, resolve issues, and ensure the deal closes without unnecessary complications.

4. Maintain a Good Relationship with Your Broker

Communicate Clearly and Often

Clear and regular communication is essential for building a strong relationship with your broker. Schedule routine check-ins to review progress, address any challenges, and refine your search criteria as needed. Be specific when discussing opportunities - share your preferences and explain any concerns. For example, if a business doesn't meet your criteria, let the broker know exactly why. This helps them adjust their recommendations and ensures the process stays efficient.

Respect the Broker's Expertise

A successful partnership with your broker relies on mutual trust and respect for their professional knowledge. Paul Vokaty, Certified Merger and Acquisition Advisor, explains:

"Business brokers typically provide a wide range of services which can be grouped into two categories: helping business owners sell their company, which is also known as sell-side engagements, and assisting potential buyers in purchasing a business, also known as buy-side engagements." [3]

To get the most out of this relationship, be open about your decision-making process, ask questions when you need clarity, and respect their timelines. Brokers bring experience from numerous transactions, offering insights into market trends and seller relationships that can help you avoid costly mistakes and spot promising opportunities.

Keep in mind, brokers have spent years building connections with sellers and understanding market dynamics. By showing professional courtesy and using their expertise wisely, you increase your chances of gaining access to top opportunities and benefiting from their full range of services.

Conclusion: Key Points for Working with Brokers

Recap of the Broker's Role

Business brokers play a crucial part in the process of buying a business. They handle tasks like due diligence, negotiations, and ensuring confidentiality during transactions. Their role goes beyond just connecting buyers and sellers - they conduct market research and offer strategic advice. Modern brokers combine strong relationship skills with financial expertise to make the process smoother, all while protecting seller relationships and keeping transactions private. By relying on their knowledge, buyers can tackle the challenges of acquisitions more effectively.

Tips for a Smooth Buying Experience

To make the most of your relationship with a broker, consider these strategies:

- Assess Their Performance: Keep an eye on how responsive your broker is, their market expertise, and their ability to find opportunities that suit your needs.

- Address Issues Calmly: If disagreements arise, discuss them openly and work together to resolve them quickly.

- Set Clear Goals: Define communication methods and establish timelines from the start.

- Use Their Knowledge: Ask for advice on market trends, business valuations, and negotiation tactics.

Typically, brokers charge a mix of fees, including an upfront retainer, monthly search fees, and a success-based commission when the deal closes. This fee structure ensures your broker stays motivated to find a business that aligns with your objectives while maintaining professionalism throughout the process.