Looking for the best business valuation software to make smarter acquisitions? Here's a quick guide to four top tools that can save you time, reduce errors, and provide accurate valuations:

-

Valutico: Advanced analytics, real-time data, and customizable reports for professionals.

-

ValuAdder: One-time payment option with step-by-step workflows and learning resources for beginners.

-

BizEquity: Affordable monthly plans with industry benchmarks and accounting software integration.

-

Cyndx Valer: AI-powered analysis for complex and niche valuations.

Quick Comparison Table

| Software | Key Feature | Pricing Model | Best For |

|---|---|---|---|

| Valutico | Advanced tools, multi-user | $3,000-$10,000/year | Serial acquirers, enterprises |

| ValuAdder | Beginner-friendly, one-time | $249 (perpetual) | Budget-conscious buyers |

| BizEquity | Industry benchmarks, scalable | $49+/month | First-time buyers |

| Cyndx Valer | AI-driven insights | Custom Quote | Tech-focused businesses |

These tools streamline valuations with features like data integration, customizable reports, and lender-approved outputs. Whether you're a first-time buyer or managing multiple acquisitions, there's a solution tailored to your needs.

Must-Have Features in Valuation Software

Data Quality and System Integration

To ensure accurate valuations, reliable data quality and seamless system integration are essential. Today's valuation tools should link effortlessly with financial platforms and industry databases. In fact, 92% of small business buyers highlight data integration as a key factor when choosing valuation software.

The best valuation software connects with widely-used accounting platforms like QuickBooks and Xero, while also pulling information from trusted industry databases. This reduces errors from manual data entry and ensures valuations stay aligned with current market trends.

User Interface and Report Options

An intuitive interface can dramatically improve how efficiently valuations are conducted. According to a survey, 86% of users place a high value on customizable report templates. The software should be easy to navigate, cater to users with varying levels of expertise, and offer mobile-friendly access for added convenience.

Key reports to look for include:

-

Executive summaries

-

Financial breakdowns

-

Market comparisons

-

Scenario models

Cost Structure Options

Valuation software typically offers flexible pricing to fit different needs, with annual plans often providing 15-20% savings compared to monthly subscriptions. Here's a snapshot of common pricing models:

| Pricing Model | Cost Range | Ideal For |

|---|---|---|

| Monthly Subscription | $50-$200 | Regular users |

| Pay-per-valuation | $99-$499 | Occasional users |

| Annual Plans | $540-$2,160 | Frequent users |

On average, users save 15-20 hours per valuation compared to manual methods. For frequent acquirers, this time savings makes the investment especially worthwhile. These features set the stage for analyzing the top four valuation platforms in the next section.

Best Business Valuation Software

4 Leading Valuation Software Options

Here are four top-tier valuation software solutions, each excelling in specific areas:

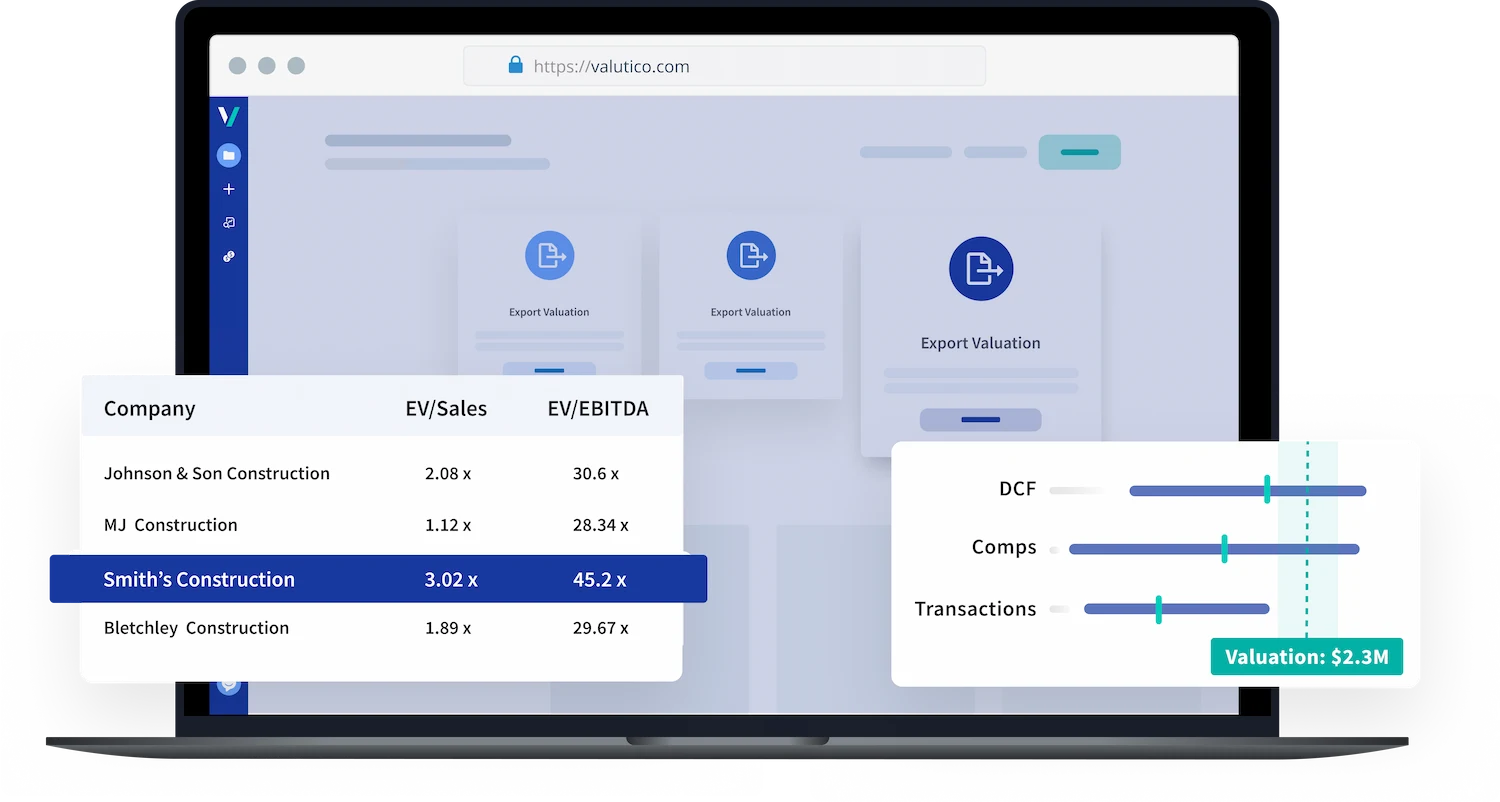

Valutico

Valutico combines advanced analytics with an easy-to-use interface. It supports various valuation methods, such as Discounted Cash Flow (DCF) and Comparable Company Analysis. With Excel integration, users can easily import data, cutting down on manual input errors. It also incorporates real-time market data and offers customizable reports for professional use.

ValuAdder

ValuAdder stands out with its one-time payment of $249 for a perpetual license. Designed to align with USPAP (Uniform Standards of Professional Appraisal Practice), this software is ideal for formal valuations. It has a Capterra rating of 4.5/5 for user satisfaction.

What makes ValuAdder unique is its step-by-step workflow and extensive learning resources. It includes five main valuation methods and detailed deal analysis tools. For small business buyers, its straightforward design and educational materials make it a great starting point.

BizEquity

BizEquity uses big data to provide sector-specific insights. Its subscription starts at $49 per month for basic features, with scalable options for growing needs.

The software excels in offering detailed industry benchmarks, helping users compare potential acquisitions to market standards. Its integration with popular accounting platforms simplifies data collection, making it ideal for analyzing multiple businesses efficiently.

Cyndx Valer

Cyndx Valer utilizes AI for advanced valuation analysis. It processes global company data to deliver results in under an hour. Pricing is customized to reflect its capabilities for handling complex valuations.

This platform is particularly effective for evaluating small tech-focused businesses or those with unconventional revenue models. Its AI-driven approach complements the sector-specific insights of BizEquity and the educational focus of ValuAdder.

| Feature Comparison | Valutico | ValuAdder | BizEquity | Cyndx Valer |

|---|---|---|---|---|

| Key Differentiation | Multiple Methods | Learning Resources | Industry Benchmarks | AI Analysis |

| Integration Level | High | Limited | Accounting Platforms | High |

| Pricing Model | Monthly Subscription | One-time Payment | Monthly Subscription | Custom Quote |

sbb-itb-cce425d

Software Comparison Chart

This comparison highlights key differences among the tools, focusing on aspects like data quality, reporting flexibility, and pricing. These factors are crucial for making an informed choice.

Feature and Price Comparison

| Feature Category | Valutico | ValuAdder | BizEquity | Cyndx Valer |

|---|---|---|---|---|

| Data Sources | Premium financial databases | Built-in industry data | Access to 33M+ business database | Combines private and public company data |

| Report Customization | Custom-branded reports in various formats | Basic templates with PDF/Excel export | White-labeled, interactive reports | AI-generated with customizable sections |

| Integration Options | API and Excel integration | Limited offline functionality | Accounting software and API integration | Full integration with Cyndx platform |

| Cost Structure | Annual subscription | One-time purchase | Monthly subscription | Pay-per-valuation |

| Unique Advantage | Advanced analysis tools for professionals | Beginner-friendly learning resources | Extensive market comparison database | AI-driven analysis for complex valuations |

Valutico stands out for its advanced tools aimed at professionals, justifying its higher price. BizEquity offers unmatched access to a vast market database, while ValuAdder is ideal for budget-conscious beginners. Cyndx Valer excels in handling complex valuations with its AI-driven capabilities.

This breakdown directly supports the criteria discussed in the next section.

Selecting the Right Software

Options for New Buyers

If you're just starting out, two software options stand out:

-

BizEquity: This platform is easy to use and provides detailed reports with broad industry data. It's a solid choice for those making their first acquisition.

-

ValuAdder: Available for a one-time cost of $249, this tool includes resources to help users learn valuation techniques. It's perfect for buyers who want to build their expertise while exploring acquisitions.

For acquisitions in the tech space, Cyndx Valer leverages AI to analyze unconventional business models, making it a strong option for more niche evaluations.

Tools for Multiple Acquisitions

For those managing multiple acquisitions, advanced features become a must:

- Valutico: Designed for enterprise use, this software offers robust tools for handling complex acquisitions. Pricing ranges from $3,000 to $10,000 annually. Here are some of its standout features:

| Feature | Why It Matters for Serial Acquirers |

|---|---|

| Advanced Analytics | Helps with scenario modeling and sensitivity analysis |

| Data Integration | Connects seamlessly with existing financial systems |

| Team Collaboration | Enables group-based analysis for better decision-making |

-

Cyndx Valer: Uses AI to pinpoint acquisition targets within specific industries.

-

Valutico: Also offers multi-user access, customized valuation methods, and 24/7 support in multiple languages, making it highly versatile for teams.

Summary and Recommendations

Here's a breakdown of the key takeaways and suggestions:

Main Points

Business valuation software is now a go-to resource for small business buyers. It simplifies the valuation process, but its effectiveness relies heavily on accurate data inputs. Remember, these tools are meant to support - not replace - professional judgment during acquisitions.

Software Recommendations

We've matched specific tools to different buyer needs:

| Buyer Profile | Recommended Tool | Why It Stands Out |

|---|---|---|

| First-time Buyers | BizEquity | Offers instant sector benchmarks |

| Budget-Focused | ValuAdder | Features a one-time cost structure |

| Serial Acquirers | Valutico | Provides enterprise-level analysis |

| Tech Buyers | Cyndx Valer | Utilizes AI for valuations |

For best results, pair these tools with other due diligence resources. Doing so ensures a well-rounded, data-driven acquisition approach.

While these tools are excellent for streamlining valuations, don't skip professional input. Many of these platforms also offer free trials, so you can test how well they integrate with your workflow.